| Getting your Trinity Audio player ready... |

Thailand Consumer Council (TCC) proposes a “Slow Payment” measure for transfers exceeding 10,000 baht, requiring banks to delay the transaction by one hour before finalizing the payment. This measure aims to enhance the security of online transactions and reduce the number of victims of fraudulent activities. TCC is also pushing forward policy recommendations to protect consumers and address financial fraud issues with relevant authorities.

(July 3, 2024): Thailand Consumer Council (TCC) held a press conference titled “Slow Payment: A Strategy to Defeat Digital Fraudsters” to voice the concerns of consumers who have suffered significant losses from fraudsters. TCC proposed measures and guidelines to prevent online financial fraud, urging relevant authorities to adopt these strategies to better protect consumers.

To reduce the damage caused by consumer fraud and to help consumers understand the “Money Delay” measure, Saree Aongsomwang, Secretary-General of TCC, stated that the problem of online financial fraud continues to occur and has become severe, causing consumers to lose money, suffer from mental health problems, and, in some cases, commit suicide as reported in the media. Therefore, TCC proposes that relevant authorities implement the “Slow Payment” measure. This would require financial service providers or banks to delay transactions exceeding 10,000 baht for at least 30-60 minutes before approving and transferring the funds to the recipient’s account. This delay would give consumers time to verify the transaction. During this delay, banks should also check with other agencies to see if the account has been flagged as fraudulent. If consumers realize they have been scammed, they can report it to the bank to request a refund.

The aforementioned measure must be set as the default system for every bank account in order to prevent consumers’ money from being immediately transferred to unauthorized or unprofessional recipients. If consumers do not wish to use this service, they can notify or present themselves to the bank to indicate that they do not want to use this measure.

“TCC wants to see a measure to delay money transfers in order to reduce the damage from being tricked into transferring money or having money siphoned off, as well as measures that will allow consumers to receive full refunds, similar to other countries that view online threats as a significant and serious problem for consumers. Since we may not be able to catch the thieves in time, the money transfer delay measure must prevent the thieves from taking our money. This would benefit consumers and be advantageous for the business sector as well,” Saree stated.

The Secretary-General further explained that the concept behind setting the amount for delayed money transfers at 10,000 baht is based on data showing that Thais make the highest number of online purchases in the world, with an average expenditure of approximately 17,000 baht per person per year. Given the general transaction behavior of people, it is expected that transactions would not exceed the referenced amount. Therefore, the 10,000-baht figure is a feasible number for implementing the delay measure. If consumers transfer money exceeding this specified amount, the funds will be delayed or held by the bank before being transferred to the recipient. This would benefit consumers by preventing their money from being immediately transferred to fraudsters and also prevent fraudsters from transferring money to mule accounts.

Many countries around the world have implemented measures to prevent online fraud by delaying payments (Slow Payment). For example, in the United States, third parties hold consumers’ money until the consumer confirms or accepts the product, at which point the seller receives the payment (Escrow Payment). This is the same system used in online marketplaces like Shopee or Lazada. In the European Union and the United Kingdom, the PSD2 (Payment Services Directive 2) law has been enacted, which specifies the duration for delaying consumer payments and mandates the number of days within which consumers should be reimbursed if they are defrauded. This determination of compensation periods represents significant progress in consumer protection, helping to build consumer confidence and reduce the burden on consumers to prove damages, as is the case in Thailand.

However, Saree revealed that from July 2021 to June 2024, TCC received 2,189 complaints related to the aforementioned issues. These complaints included downloading loan applications only to face interest charges that did not comply with legal regulations, money being siphoned off after clicking fake links, being tricked into online investments using fake artificial intelligence (AI) posing as famous investors, fake Facebook fan pages selling products online under the guise of government agencies, and investing in illegal digital assets through unauthorized apps. These complaints have caused consumers to lose over 294 million baht. TCC has assisted in negotiating and mediating to help consumers recover more than 42 million baht. However, the amount recovered is still relatively small compared to the total damages incurred. Therefore, TCC has submitted policy proposals to various government agencies and platform service providers to enhance consumer protection.

The TCC’s Secretary-General praised the Technology Crime Suppression Center and the Cyber Police Hotline 1441 for providing advice and coordinating with banks to freeze accounts. However, she emphasized the need for police officers who can handle complaints comprehensively to reduce the redundancy of filing multiple reports. Additionally, online platforms should be held accountable for collaborating in consumer protection, as these platforms currently serve as channels that allow fraudsters to deceive consumers or permit the purchase of advertisements that increase the visibility of fraudulent content to consumers.

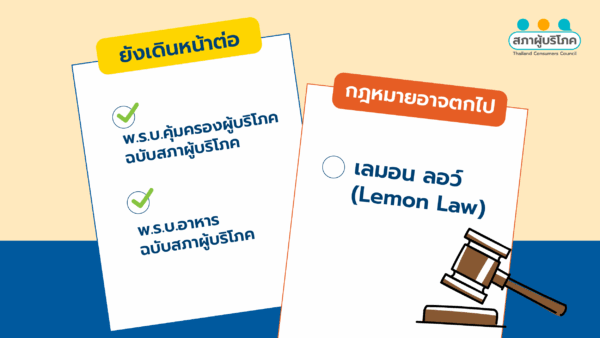

Additionally, this year, the Office of the Consumer Protection Board (OCPB) is preparing to introduce a new law allowing consumers to “inspect the product before payment” to help reduce issues with cash-on-delivery online purchases where the received items do not match the description. If a problem with the product is found, a refund can be requested within 5 days. This initiative is a positive step that the OCPB is taking forward from the Ministry of Digital Economy and Society (MDES) and Thailand Consumers Council, who have been advocating for consumer protection to allow “open before payment.” Furthermore, consumers are encouraged to file complaints and exercise their consumer rights more actively. Even though many may experience inconvenience or delayed compensation, a large number of complaints will highlight to government agencies and service providers the widespread distress among consumers, prompting them to urgently find preventive measures and solutions.

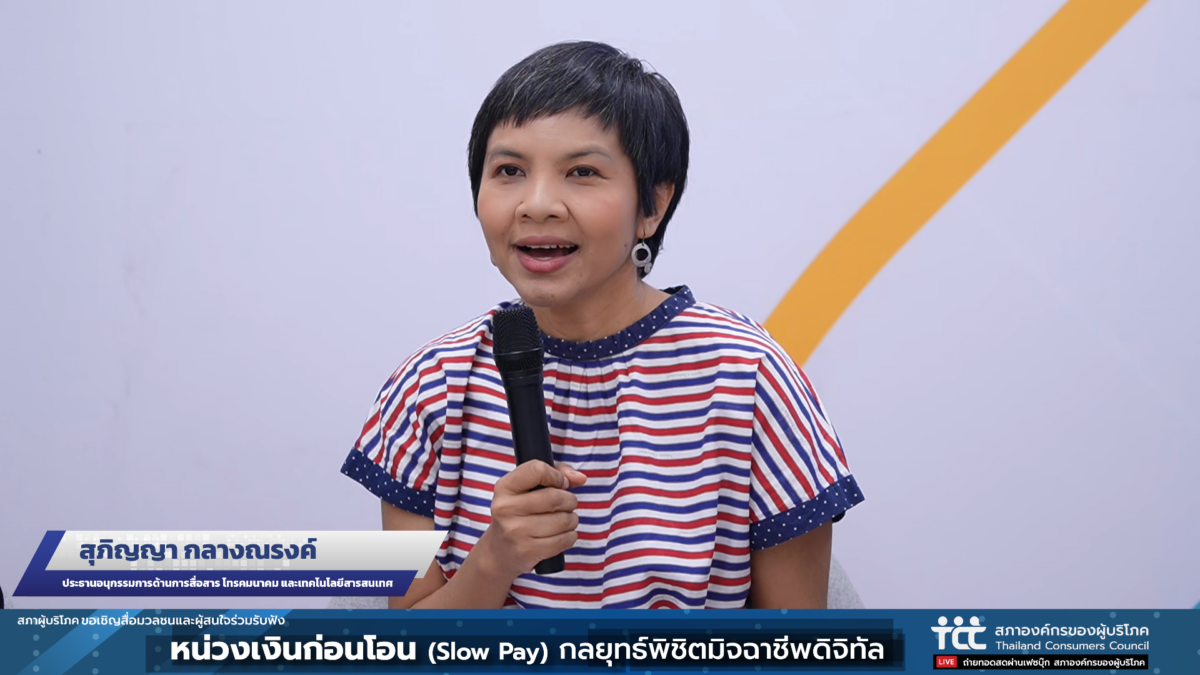

Supinya Klangnarong, Chairwoman of TCC’s Communications Telecommunication and Information Technology sub-committee stated that during the year 2566 (B.E. 2566, which corresponds to 2023), Thailand was ranked number one for online fraud and dishonesty, according to rankings compiled by the Whoscall application. The estimated value of the damage caused is around 30-50 billion Baht. Currently, a technology known as ‘Sim Box’ is being used, which is a device that converts telephone signals and can accommodate multiple SIM cards, making up to 600,000 random calls per day to find other parties. When this widespread problem occurs, it is necessary to address it structurally and through policy, as well as launch aggressive campaigns and warn the public in advance. However, there has not been any such action taken by the government so far.

Supinya believes that the National Broadcasting and Telecommunication Commission (NBTC) has more potential for detection and prevention than is currently being implemented. Therefore, she suggests that the NBTC and relevant agencies warn the public about the issue of Sim Box fraud. Moreover, it is crucial to address the issue through policy measures. She hopes to see the NBTC Chairperson or it’s Secretary-General issuing a public policy on how to address this issue. This is what we expect from the NBTC.”

In addition, Supinya proposes three recommendations to the relevant agencies as follows:

1. Request the NBTC, which oversees frequency waves and telecommunications devices, to proactively alert the public about Sim Box fraud.

2. Ask the NBTC to disclose or clarify to the public the process of granting permissions for Sim Box use, detailing who has been granted permission and to publicly disclose the results of raids and apprehensions of individuals engaging in fraudulent Sim Box activities.

3. Urge the NBTC to develop and communicate to the public how they plan to collaborate with government agencies responsible for these matters, including presenting public policy reports on how to manage Sim Box and illegal SIM card usage to instill confidence in the public.

Supinya mentioned that five years ago, measures like ‘Prompt Pay’ might have been put in place, but it is now being exploited by dishonest individuals, resulting in over 50 billion Baht in damages. ‘Prompt Pay’ might have turned into ‘Prompt Collapse.’ Therefore, implementing ‘Slow Payment’ measures could be an option for users who wish to mitigate the risks associated with money transfers.

Supinya also expressed a desire for various related agencies, including the Ministry of Digital Economy and Society, the Bank of Thailand, and the NBTC, to collaborate in designing and developing technology that promotes ‘Security by Design & Default’, ensuring user service security. This system should be accessible to all genders and ages, particularly beneficial for the elderly, who are often targeted by scammers. Having a system that anonymizes incoming calls could prevent phone scams. Governments and relevant ministries should already have centralized public databases and should enhance cooperation to better protect this group of people.”

Even though state agencies, cyber police, financial institutions, and related organizations like the Bank of Thailand have implemented measures to prevent online financial fraud and issued continuous warnings, these measures tend to be more reactive rather than proactive, focusing on addressing issues downstream rather than tackling root causes or taking preemptive actions. Kamon Kamontrakul TCC‘s Policy Board Committee, has proposed the following consumer protection measures:

1. Telecommunications network service providers should verify the technical aspects of their communication systems. Financial service providers should conduct rigorous checks and promptly suspend any transactions found to be irregular or suspicious. They should also notify or inquire with the account owners.

2. Regulatory agencies overseeing online platforms should suspend platforms that facilitate illicit activities or violate consumer rights.

The measures to address the root causes of these problems can be observed in countries like Singapore and China, where existing laws have been updated to be more relevant and enforceable in an era when online financial fraud is widespread globally. Reforms such as the Cybersecurity Act and Computer Misuse Act in Singapore and The Cybersecurity Law in China aim to hold telecommunications network service providers, financial service providers, and various platform providers accountable for any unethical practices used to deceive consumers. Therefore, if these service providers fail to take responsibility, cooperate in solving issues, or implement adequate data and financial security measures that result in consumer harm, they should be legally liable and face penalties.

Furthermore, Kamon suggests that empowering a specific government agency to supervise and address online financial fraud is imperative due to the significant damage and losses suffered by consumers today. Governments should study the laws of countries that have addressed these issues effectively, such as Singapore, China, or the United States, and adapt them to combat these problems. Expedited compensation for consumer losses should be a priority as many consumers face financial losses, with some experiencing extreme stress leading to self-harm or suicide. Laws, measures, or regulations introduced to tackle these issues should include severe penalties for service providers to instill fear and encourage collaboration in preventing online financial fraud and protecting consumers.

The measures to address the root causes of these problems can be observed in countries like Singapore and China, where existing laws have been updated to be more relevant and enforceable in an era when online financial fraud is widespread globally. Reforms such as the Cybersecurity Act and Computer Misuse Act in Singapore and The Cybersecurity Law in China aim to hold telecommunications network service providers, financial service providers, and various platform providers accountable for any unethical practices used to deceive consumers. Therefore, if these service providers fail to take responsibility, cooperate in solving issues, or implement adequate data and financial security measures that result in consumer harm, they should be legally liable and face penalties.

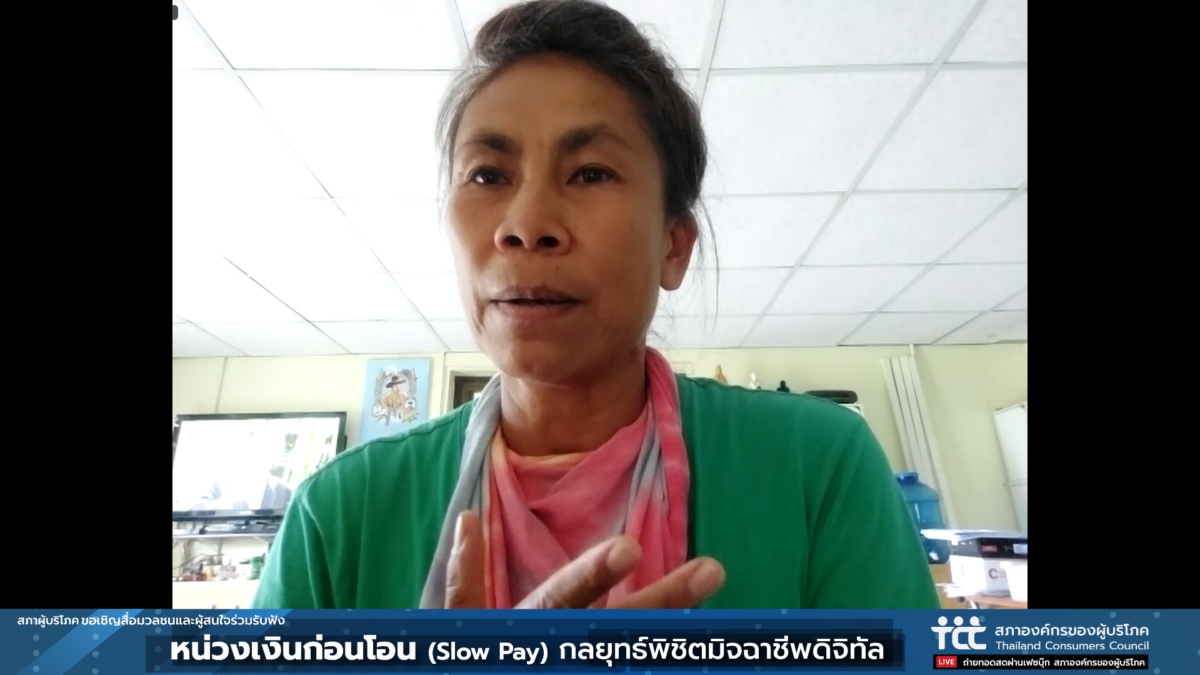

However, in this press conference, consumers who have suffered from online financial fraud expressed their frustrations. One of the victims, Ms. Sangpracha Jamlak, revealed that she received a call from someone claiming to be an officer from the Land Department, stating that her land ownership needed to be updated. Subsequently, she was asked to download an application from the Land Department to register and inquire about the banking applications available. Upon informing them that there were no such applications, the fraudulent party insisted that she install the K Plus application, then asked him to scan her face to unlock the app. She then received a notification of a bank account balance within Kasikornbank. When she realized she couldn’t control his phone afterward, she suspected she had been scammed and quickly contacted the bank to freeze all her accounts. She then reported the incident to the police station and discovered that the fraudsters had transferred 100,000 baht from her KTC credit card to her Kasikornbank account.

After attempting to resolve the issue independently several times without any progress, she decided to file a complaint with TCC. She expressed her gratitude to the TCC for not having to face the situation alone and realizing that there is consumer protection organization ready to advocate and assist in further legal actions.

“When I went to report to the bank, one bank officer mentioned that scammers are smart. However, when I asked whether the bank should be smarter than scammers, the bank couldn’t provide an answer. The bank should enhance their systems to be more secure. You prioritize convenience but overlook security aspects. We don’t even have the app for Krung Thai Bank, but the scammers managed to take money from our KTC credit card,” stated Sangpracha.

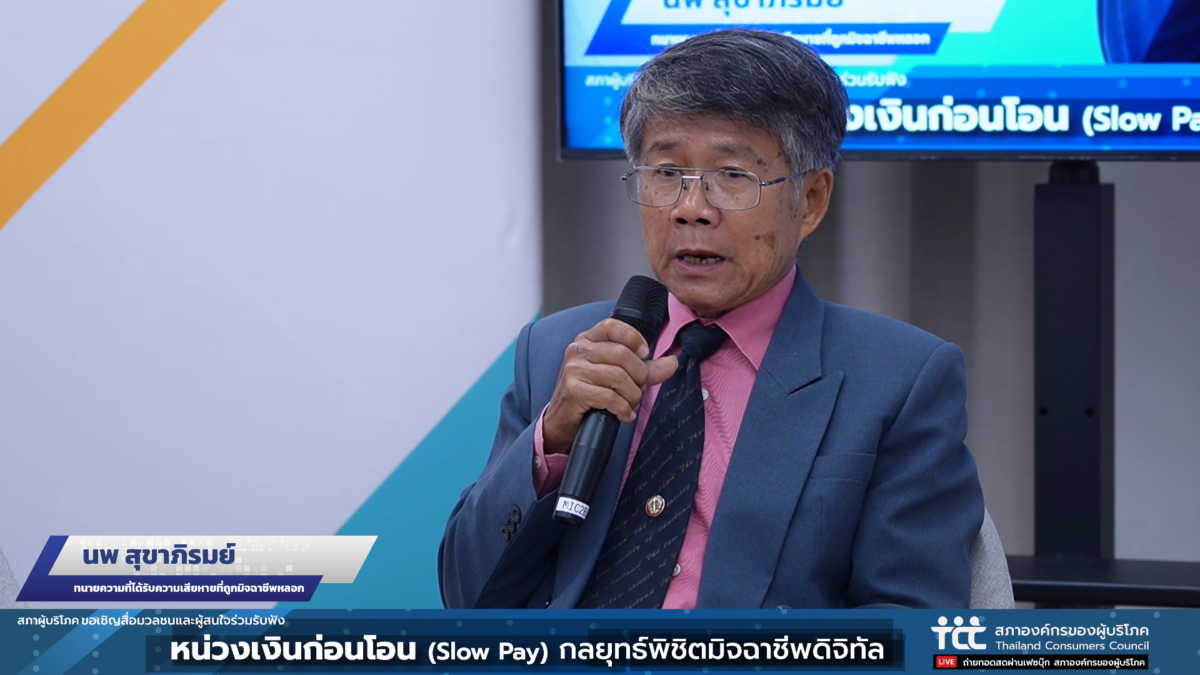

Another victim, Nop Sukhaphirun, disclosed that he had been scammed by a gang pretending to be a transportation company offering refunds of 1,000 baht for damaged goods. He fell for the deception as there were authentic-looking documents sent by the supposed company. Subsequently, he was asked to download an application related to the transportation company, but after scanning his face, he lost control of his phone, which then shut down. When he managed to restart his phone and accessed the app, he found that all his money had been transferred out of his account. Upon realizing the loss, he promptly reported the incident at the local police station in Ratchaburi town. The police then contacted the Anti Online Scam Operation Center (AOC) hotline number 1441 for immediate action, but within 11 minutes, the money had already been transferred to several accounts, including overseas accounts.

Yupaphon Sirikijpanichapannakit, Assistant Permanent Secretary of the Ministry of Digital Economy and Society (DES), stated that DES has established the Anti Online Scam Operation Center (AOC) hotline number 1441 to provide comprehensive assistance and respond to online threats after criminal activities. The main mission is to freeze money in scammers’ accounts. The AOC will coordinate among the center, victims, and banks to provide initial information to the police for swift action. This process streamlines the previous procedure of reporting to the police before contacting the bank, enabling quicker freezing of accounts.

Assistant Permanent Secretary of DES shared insights on the operation and assistance provided to consumers by the AOC. When contacting the hotline 1441, victims are required to provide information on the method of operation of the scammers, details of the deception, and other relevant information. They should also specify the police station where they intend to report the incident. After completing the process, the victim will receive a Bank case ID. The conversation details are forwarded to the Thaipoliceonline system, the police’s online reporting system. Subsequently, the victim needs to file a formal report at the chosen police station within 72 hours to confirm their identity.

Regarding the issue of refunding money, Ms. Yupaphon mentioned that while it is possible to freeze accounts and hold funds, the money will not automatically be returned to the victims. Therefore, it is imperative to determine how the victims will be refunded. If a quick refund process is desired, legal amendments are necessary. Typically, returning money resulting from criminal activities requires a judicial process, which can be time-consuming. However, with legal amendments to facilitate investigations into genuine victims, funds can be returned promptly.

She also mentioned the development of the Central Fraud Registry (CFR) system, which facilitates the exchange of financial information among multiple banks and law enforcement agencies. The faster the processing through this system, the better the prevention of losses.